1 2 Transaction Analysis- accounting equation format Financial and Managerial Accounting

We’ve also included assumptions for depreciation, CapEx, interest rate, tax rate, and changes in working capital. Let’s now walk through a full paper LBO example, beginning with a prompt that contains the key transaction assumptions and financial model details. Even though the below screenshots are in Excel, this analysis is done with pen and paper only.

Determining the Effects in Terms of Increase and Decrease

In five years, our analysis suggests an $860 million exit equity value. Since the sponsor equity investment was $300 million, this suggests an MOIC of 2.9x ($860 million/$300 million). However, the 2.9x should be rounded to 3.0x in a paper LBO. Next, we can fill in our cash flow statement or free cash flow calculation. We can then deduct depreciation of $8 million to derive EBIT.

What account type does each of the accounts involved belong to?

Since sources must equal uses, and we already know the total uses, we then backsolve for the amount of equity financing the PE firm will invest. With total uses of $600 million and $300 million in debt financing, this means the PE firm will need to invest $300 million in equity ($600 million minus $300 million cancelled debt in debt financing). The PE firm’s equity investment is often referred to as sponsor equity, since the PE firm is considered the “sponsor” of the LBO transaction. The purchase enterprise value is considered the actual purchase price since most acquisitions occur on what’s known as a cash-free, debt-free basis.

Example of a Paper LBO Analysis

On the liabilities and equity side of the equation, there is also an increase of $20,000, keeping the equation balanced. Changes to assets, specifically cash, will increase assets on the balance sheet and increase cash on the statement of cash flows. Changes to stockholder’s equity, specifically common stock, will increase stockholder’s equity on the balance sheet. The main focus of this course will be the asset side of the balance sheet (statement of financial position).

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Great! The Financial Professional Will Get Back To You Soon.

The types of information required for making a transaction typically depend on the type of transaction being conducted. However, common types of information required may include name, address, payment details (e.g. credit card or bank account), and contact details. Transactions provide a secure and efficient way to exchange value between parties. They also enable both parties to keep track of all exchanges, simplifying records management and accounting. Transactions are the business events, measured in money, and recorded in the financial record of a particular enterprise.

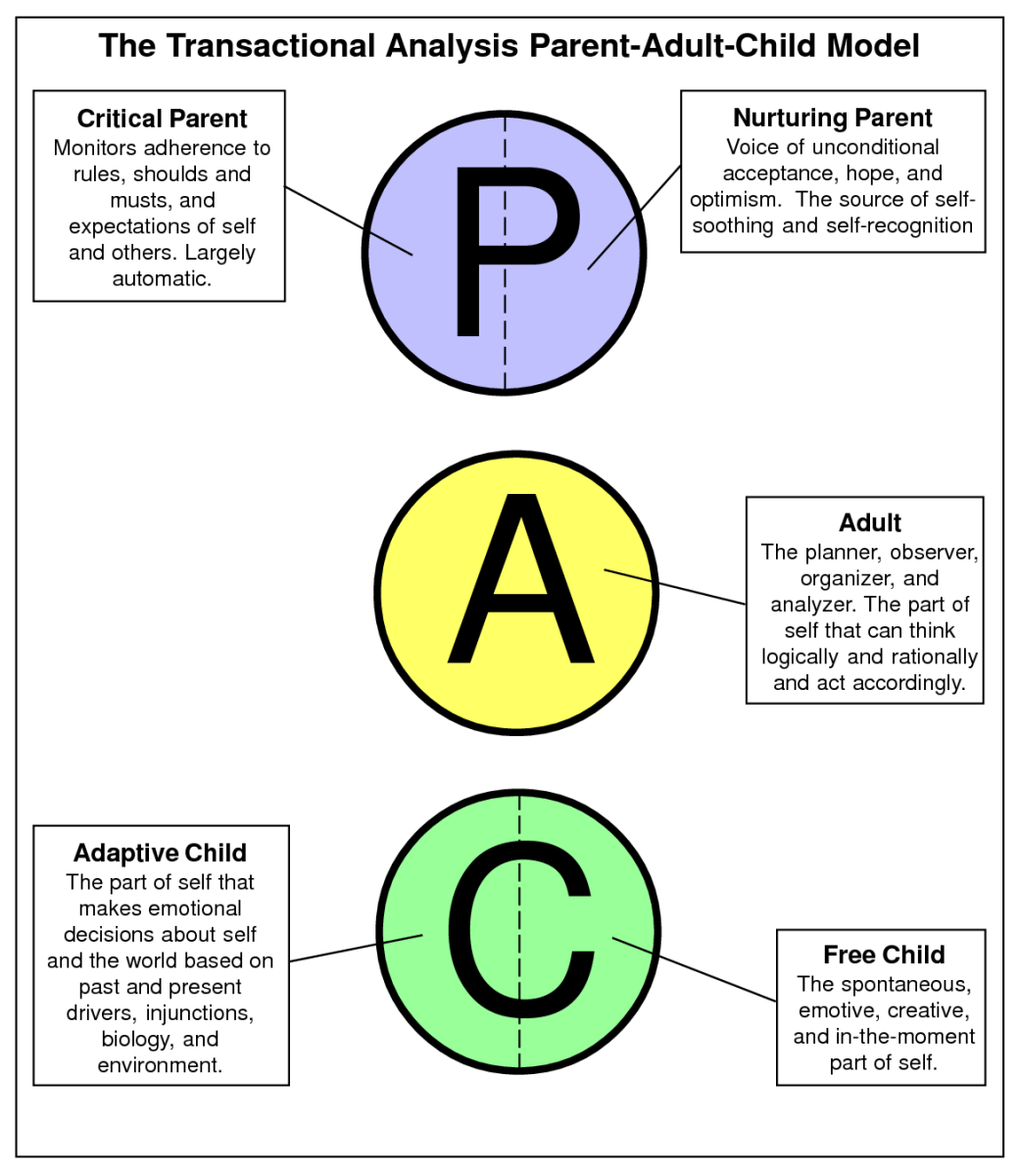

Both will cover WHAT transactional analysis is and how to apply it. Practice looking for opportunities to develop your choices through transactional analysis, and you’ll see a marked improvement in your communications at all levels in your life. An example might be where a customer has a very demeaning attitude to you, complaining that you should be their servant and get a move on, or they’ll take their business elsewhere. You’ll have heard of ‘ulterior motives’ or ‘hidden agendas’. This is where a person’s behaviour or statements say one thing, while surreptitiously or subconsciously meaning something else. Whereas the child and parent state may be driven by past experiences and conditioning, the adult state considers the here and now situation.

Also, note again that every transaction affects at least two accounts and that the total amount added to the debit side equals the total amount added to the credit side. This demonstrates double-entry accounting, which keeps the accounting equation in balance. As a second example of accounting transaction analysis, suppose a business is started with a capital injection of 30,000 cash by the owner. The accounting transaction analysis described in the six steps above, is best set out in table format to ensure that important considerations about the transaction are not overlooked.

- These statements tell you how profitable your business is and how you should spend your money going forward.

- A compound entry is when there is more than one account listed under the debit and/or credit column of a journal entry (as seen in the following).

- Notice that for this entry, the rules for recording journal entries have been followed.

- This attention to detail is crucial to building a long-lasting, profitable company.

In other words, a journal is similar to a diary for a business. When you enter information into a journal, we say you are journalizing the entry. Journaling the entry is the second step in the accounting cycle.

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.