Analysis of Business Transactions Definition, Explanation and Example

Note that this example has only one debit account and one credit account, which is considered a simple entry. A compound entry is when there is more than one account listed under the debit and/or credit column of a journal entry (as seen in the following). The asset Cash is decreased because a check was written to pay for the equipment.

- Or they may be flippant and joke around, covering up for some inadequacy seen by the parent model.

- In order to record this financial data so that eventually we can produce the financial statements, we use the accounting equation and its elements to record business activities.

- The purchase enterprise value is considered the actual purchase price since most acquisitions occur on what’s known as a cash-free, debt-free basis.

- Cash will decrease by $10,000 and owner’s equity will also decrease by $10,000.

- This process begins with an analysis of the impact of each transaction (financial event).

- We’ll review how each transaction affects the basic accounting equation.

What is Accounting Transaction Analysis

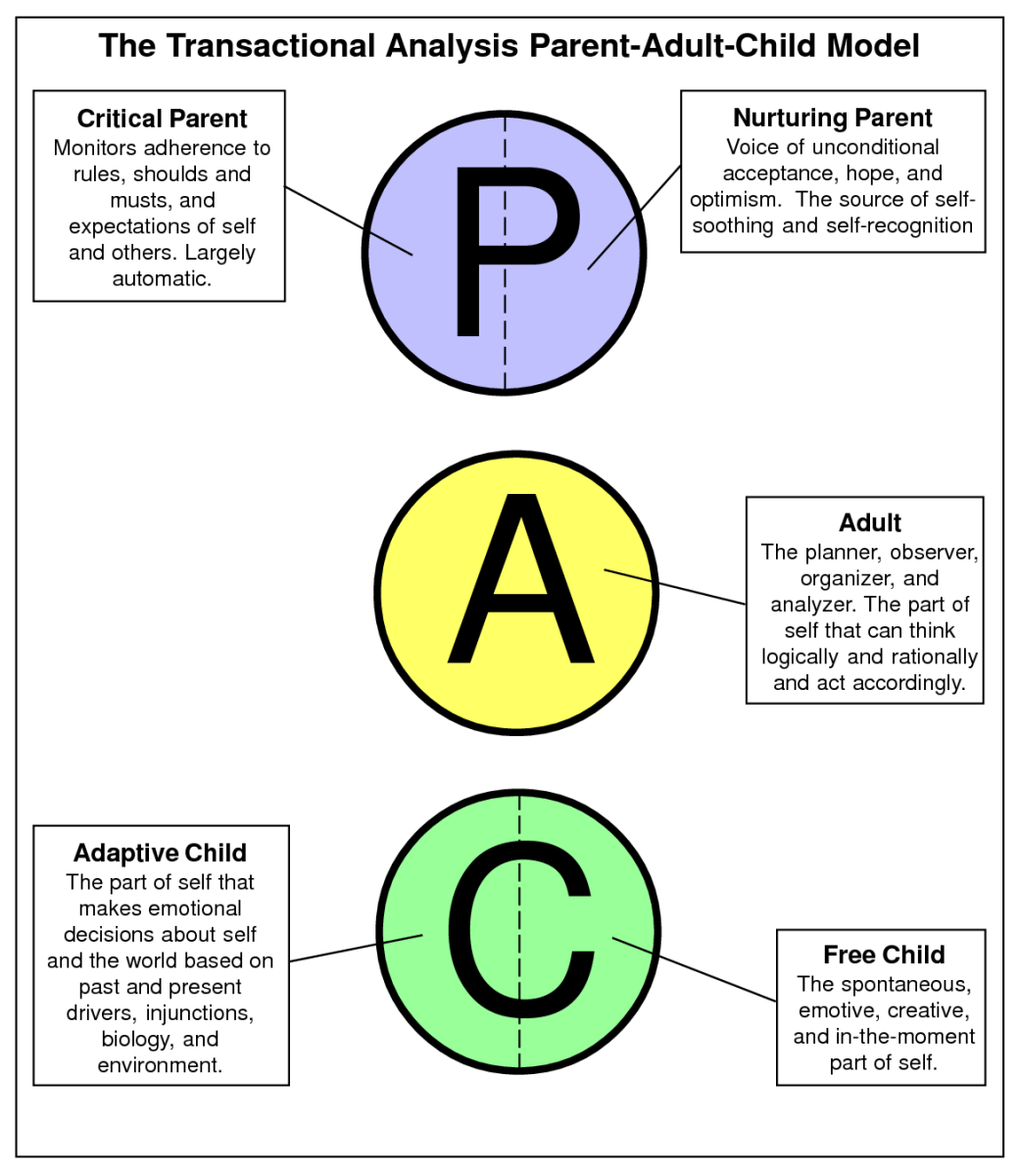

A nurturing parent ego state would drive a person to be more understanding and softer in their approach. They would see a situation without judging, attempting to be more curious as to why a person would say or do something. A nurturing disposition may be helpful in trying to calm situations down or when establishing closer relationships. Eric Berne believed that the biggest contribution to how we view the parent state was decided in the first few years of life. One way of looking at a parent state is concerning the judgements we have of others and of situations. Our rules and standards often come from these parental figures.

Transaction Analysis in Accounting

The accounting cycle procedure begins immediately upon the occurrence of a business transaction. Each account can identified with an account type, either assets, liabilities, equity, revenue or expenses. Using the rent example, the cash account would be identified as an asset account, and the rent expense account is identified as an expense account. The Accounting Cycle begins with the analysis of transactions.

2 Transaction Analysis- accounting equation format

As the name implies, there are two entries involved in this process, which involves a debit and a credit. When financial transactions are recorded, income tax definition combined effects on assets, liabilities, and equity are always exactly offsetting. This is the reason that the balance sheet always balances.

Step 1 Bold City Consulting received cash from the bank in exchange for a signed note agreeing to pay the cash back in two years. The accounts involved in the transaction are Cash and Notes Payable. It would be impossible to emphasize the significance of precise transaction analysis in commercial accounting. Proper transaction analysis is crucial for creating accurate financial accounts. This can lead to incorrect log entries and mistakes in the accounting records. In the double-entry accounting system, every transaction affects at least two accounts.

Therefore, the company has a liability to the customer to provide the service and must record the liability as unearned revenue. The liability of $4,000 worth of services increases because the company has more unearned revenue than previously. Various definitions of terms used in accounting were provided earlier in the chapter. As a reminder, the accounting process for recording transactions is very methodical and repetitious. The diagram below is a summary of how accounting transactions will flow. A simplified account, called a T-account, is often used as a teaching or learning tool to show increases and decreases in an account.

In the first step of transaction analysis, the names of these accounts are identified and extracted from the transaction. The account titles so obtained must be in line with the account titles listed in the organization’s chart of accounts (COA) and used in the general ledger. For example, Mr. Robert starts a trading business, namely Robert Traders, by investing $50,000 cash. The two accounts involved in this transaction are “Cash Account” and “Robert’s Capital Account”. The accounting cycle begins with the analysis of transactions. The proper analysis of business transactions is important because it ensures that entries in the journal are correct.

Step 4 An increase in the asset Cash is a debit; an increase in the revenue Service Revenue is a credit. Step 4 An increase in the asset Cash is a debit; an increase in the liability Notes Payable is a credit. The liability Notes Payable is also increased because it represents an obligation owed to the bank. Notice that the name of the account being credited is indented in the journal. This format is a standard way to differentiate the accounts that are credited from the accounts that are debited.