How to use the days inventory outstanding formula: Examples & best practices

In addition to being an indicator of ordering and inventory management efficiency, a high inventory turnover ratio and low DIO means higher free cash flows. DIO is a metric that shows how long it typically takes for a company to sell all of its inventory, giving insight into its efficiency. You measure the frequency of inventory turnover by calculating how many times inventory is sold and replaced within a specific time frame.

Optimise your inventory management

Lower ratio typically signifies efficient inventory management and rapid sales. An increasing index might hint at issues with demand forecasting or sales processes, while a decreasing number often signals strong sales and efficient inventory turnover. A lower scale reflects efficient inventory management and a faster sales process.

DIO Calculator

- Below is the list of top companies in Discount Stores and their Market cap and outstanding inventory days.

- If the company’s DIO is shorter than its peers, it means that it has a very efficient inventory management system.

- Basically, DSI is an inverse of inventory turnover over a given period.

- DIO won’t give a direct understanding of profitability in the same way profitability ratios will, but it is useful none the less.

On the other hand, if the company’s DIO is longer than its peers, it should consider improving its inventory management system. If the company doesn’t pay more attention to its stock, those products may expire or become obsolete. The single most important purpose of calculating DIO is to analyze a company’s inventory management efficiency. The shorter the DIO, the more efficient the company’s inventory management system is. While inventory value is available on the balance sheet of the company, the COGS value can be sourced from the annual financial statement. Care should be taken to include the sum total of all the categories of inventory which includes finished goods, work in progress, raw materials, and progress payments.

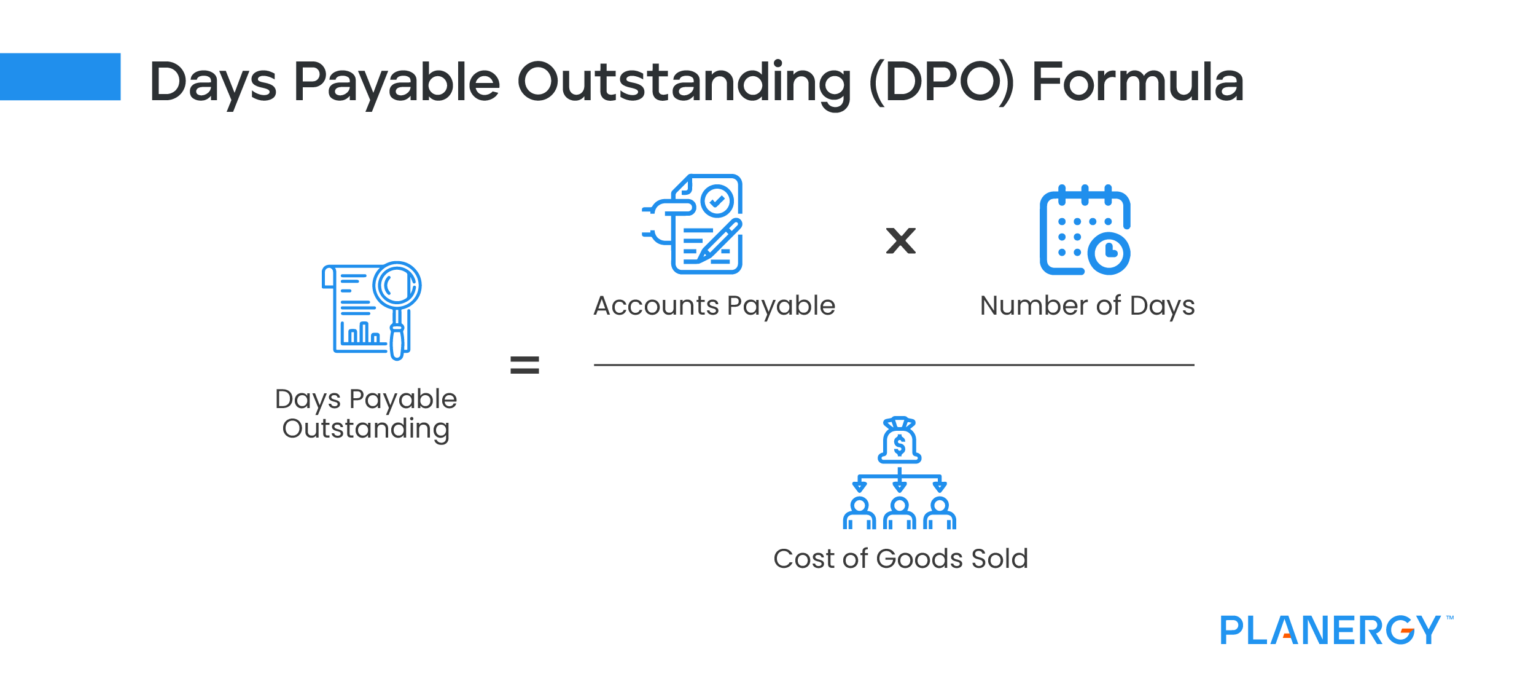

Days Inventory Outstanding Formula (DIO)

This article will help you understand what is days inventory outstanding and how to calculate days inventory outstanding. Reducing your DIO means you’re converting inventory into cash faster, a good sign for liquidity and overall financial health. It involves discontinuing, consolidating, or discounting slow-moving inventory to free up space for fast-selling items, or potentially even throwing out or donating unsellable stock. Inventory rationalization is the practice of reviewing and optimizing a company’s inventory to ensure that only the most necessary, profitable, and in-demand items are being stocked.

Inventory Turnover Ratio vs. Inventory Days

More effective sales and marketing could increase demand for a product, reducing the amount of inventory that stays on the shelves. Better anticipation of how much inventory it will need to have in stock could help reduce the amount of inventory that remains unsold. This generates revenue that can be put back into the business to pay for ongoing operations, and to invest in continued productivity and growth.

Sales performance

A sudden surge in demand can have the opposite effect, reducing your DIO despite no improvements being made to boost efficiency. This is typically interpreted to mean that the business is turning over (selling) its inventory at a slower pace, which is something that it should strive to improve. It is important for a business to convert inventory to cash as quickly and efficiently as possible. To track changes in inventory management efficiency and identify areas for improvement, DIO should be monitored often, usually monthly or quarterly. On the other hand, effective management, reflected in a lower value, helps minimize these risks and optimize storage costs. If the industry average ratio is 60 days, TechMart’s inventory turnover appears to be slower than its competitors.

This tells us that, on average, John’s Pharmacy held its inventory for 54.75 days before it was sold. Because pharmacies typically sell perishable goods, a DIO of 54.75 days could mean some goods expire before they’re able to be sold – not ideal for a business looking to efficiently manage its inventory. A high number reveals that the business takes longer to sell its inventory. This could indicate that one or more aspects of the process call for improvement.

Consider the scenario of a warehouse stocked with inventory while cashflow remains tight. Use an ABC analysis to sort items into those with the highest influence on the overall stock average days inventory outstanding based on value and sales volumes. A lower DIO result is preferable because it indicates inventory is moving more quickly and contributing to a healthier level of working capital.